do travel nurses pay state taxes

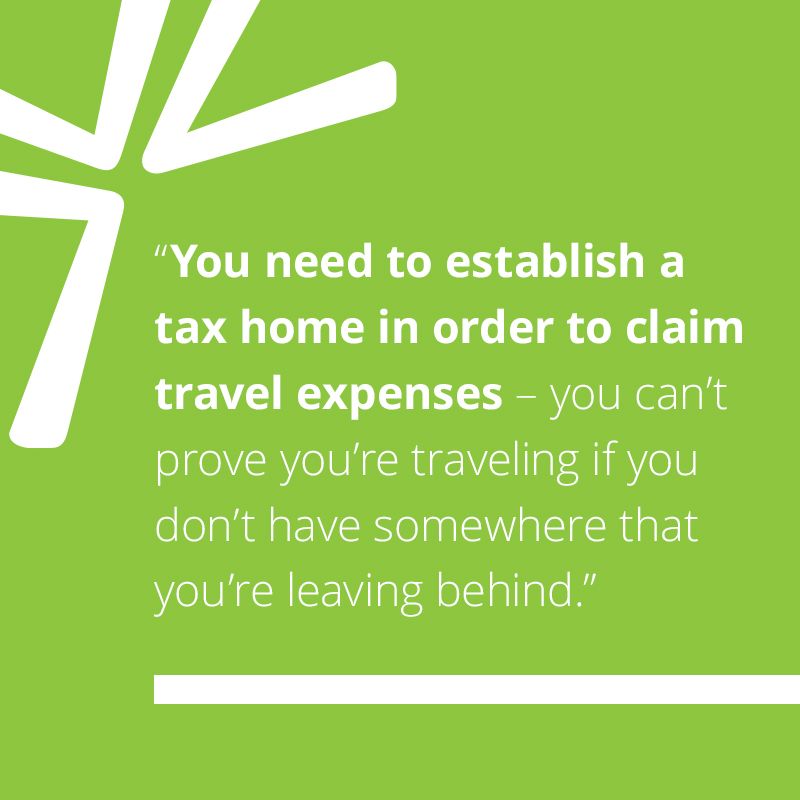

Travel Nurse Tax Deduction 1. If you earn a minimum of 25 of your income in the geographical area.

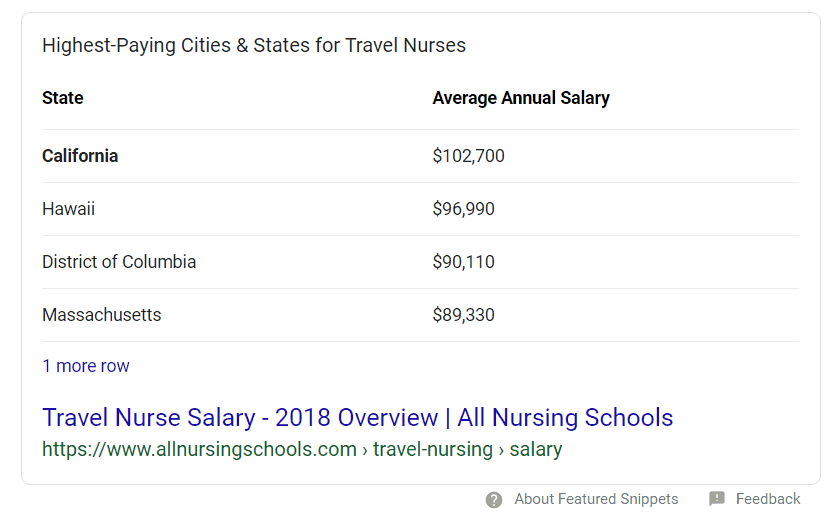

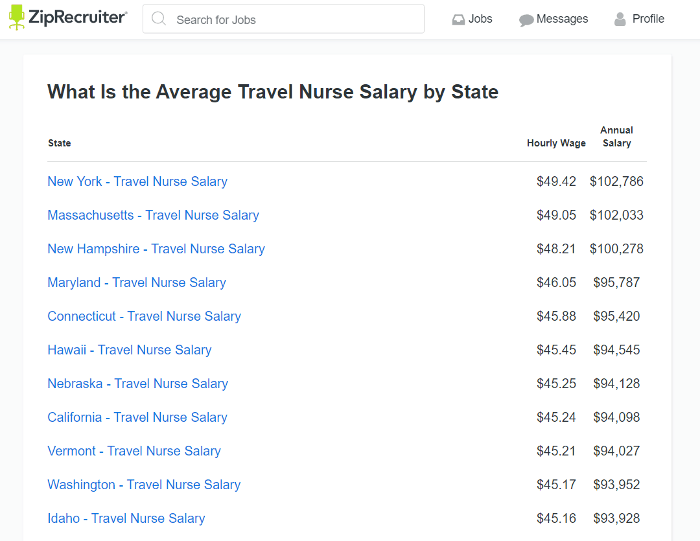

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

This takes a depth of understanding of state tax returns that most people dont have.

. Tax homes tax-free stipends hourly wages bonuses benefits housing and per diem reimbursement are all factors to consider when understanding your travel nursing pay and taxes. State income taxes or would my retirement pe. This is the most common Tax Questions of Travel Nurses we receive all year.

It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable. Its also worth really familiarizing yourself with the tax implications of working in a different state as the wage component of the total compensation package will translate differently as take-home pay from one state to the next. Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming.

My question is would ONLY the income earned in Ca. You may be subject to state income tax in both the state of your permanent residence and the states where you had travel nurse jobs. Here is an example of a typical pay package.

Where do travel nurses pay state income taxes. But state law company policies and the terms of your travel nursing assignment contract may provide additional overtime pay and an increased holiday pay rate. The only condition to qualify for Tax-Free income is that the traveler must be working in a state that is not their tax home.

Both of these issues can throw your calculations off significantly. Make sure to check state laws as you may end up paying state income taxes in more than one state if you live in one but work in another. In most situations yes.

It is common practice for states that charge income tax to tax travel nurses even though they might not be permanent residents of that state. 1099 employees expecting to owe over 1000 in taxes have to file and pay taxes quarterly whereas W2 employees have taxes withheld every pay period but only have to file annually. Negotiate travel nursing pay like a PRO with our free eBook.

500 for travel reimbursement non-taxable. This approach is not recommended for two reasons. Also some states allow whats called a reciprocity agreement which requires you to pay tax for just one state where youve lived.

Not just at tax time. Because travel nurses are expected to travel to different parts of the state the country and in a few cases even the world employers will often reimburse them or even provide a stipend for their travel costs. I could spend a long time on this but here is the 3-sentence definition.

We sat down with tax expert Brendan Willmann to learn the secrets to paying less travel nurse taxes. Know which states charge income tax. Conversely if I am from a state with an income tax I will pay my home state tax rate on all the income earned in a state without an income.

Deciphering the travel nursing pay structure can be complicated. Are employers required to withhold out-of-state taxes. The exception is that one of the states has a reciprocal agreement with the state where you live.

Second states have substantially different state tax rates. For most travel nurses hourly wages will be reported on a W-2 form and subject to 1530 in payroll taxes. There are two ways you can be paid as a travel nurse.

When it comes to paying less travel nurse taxes Willmann says his most. Therefore these rules do not apply. This can result in inconveniences for business travelers complexity for travel and finance managers or bigger business implications like fines.

Hi there I am considering travel nursing to California but I do not know how the state income tax works there. I live in Florida and receive a retirement pension form the military. States that do not have an income tax are not exempted.

You have a permanent residence. This means that the more money you make the higher your tax rate is and vice-versa. First some states have a 50-mile rule for state legislators to qualify for the tax-free reimbursements the states pay to legislators while conducting state business.

The rules vary for withholding income tax on employees who temporarily travel outside of their resident state for work. 1 A tax home is your main area not state of work. 41 states have income tax.

You will pay state income taxes in whichever state you work. Like everyone else travel nurses pay tax on their income but the unique nature of travel nursing means its possible to lower your tax bill and keep more of your money in your pocket. Travel nurse tax tips.

First taxes are progressive. Travel nurses generally qualify for tax-free stipends if they meet two of the three requirements for tax homes which are. As a travel nurse working outside of your tax home you are eligible for tax-free stipends in addition to the hourly wages you earn.

Nursing explains that every state has different laws for filing taxes but travel nurses must file a non-resident tax return in every state they have worked in as well as the state thats your permanent tax home. The ultimate travel nursing pay calculator. Of the fifty United States nine dont require you to pay state income tax.

Tax-Free Stipends for Housing Meals Incidentals. They simply have a 0 rate. As mentioned above 1099 travel nurses have to pay the 153 SE tax rather than ½ of FICA for W2 employees.

250 per week for meals and incidentals non-taxable. How many states have state income tax. If you work in more than one state you have to file travel nurse taxes in each location.

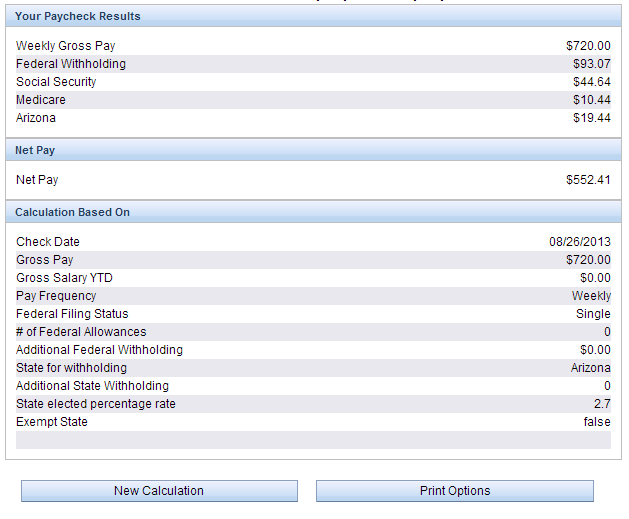

Or are paid a fully taxable hourly wage taxed on the. 20 per hour taxable base rate that is reported to the IRS. This is helpful if your travel.

The most prominent Travel Nurse Tax Deductions are Tax-Free Stipends for Housing Meals Incidentals Travel Reimbursements and Professional Development Costs. Travel nurses are paid a blended rate of tax-free stipends and taxable hourly wage. 2000 a month for lodging non-taxable.

Travel Nursing Tax-Free Stipends and Permanent Tax Homes. If I am a resident of any of these states or the USVI I am not exempt from paying state taxes in the states that I work. Be subject to Ca.

Smith advises travel nurses keep a receipt book to help them make tax preparation a little easier by having all of their paperwork in one. Your blended rate is calculated by breaking down your non-taxable stipends into an hourly. With the continuation of the COVID-19 pandemic travel nurses are up against some unique challenges in 2022.

States have a state income tax but Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming dont. Do travel nurses pay state income tax in states where they work. Obviously travel nurses are not state legislators and states dont pay travel nurses.

2021 has been a unique year for travel nurses and some pay packages were different from traditional travel.

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

Travel Nurse Tax Pro Home Facebook

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Travel Nurse Salary Comparably

Travel Nurse Irs Audit Why They Occur And What To Expect

Travel Nurse Tax Deductions What You Need To Know For 2018

How Much Do Travel Nurses Make Factors That Stack On The Cash

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

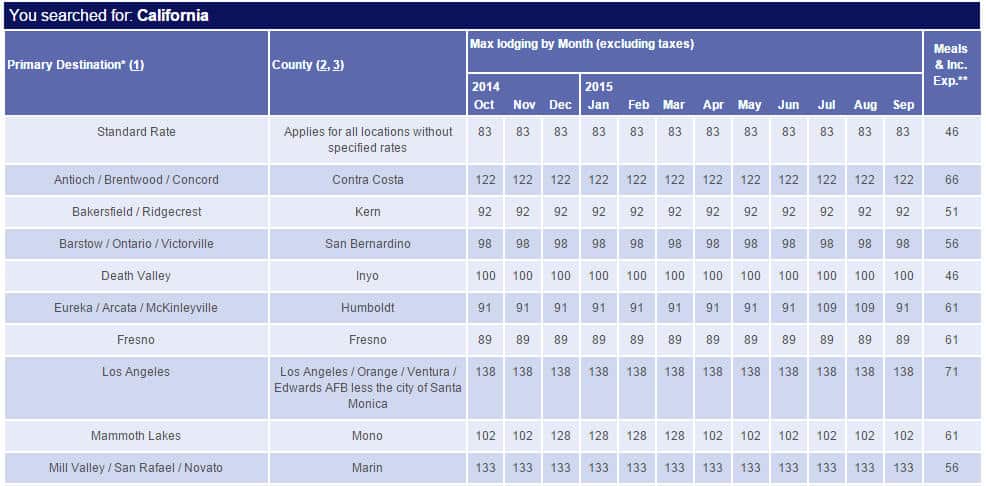

6 Things Travel Nurses Should Know About Gsa Rates

Trusted Event Travel Nurse Taxes 101 Youtube

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

How Do Taxes Work For A 1099 Travel Nurse Clipboard Academy

All You Need To Know About Travel Nursing In The Us Infographic Travel Nursing Nursing Programs Nursing Tips

How To Calculate Travel Nursing Net Pay Bluepipes Blog

How To Handle Tax As A Travel Nurse Ventura Medstaff

Are There Red Flags For The Irs In Travel Nursing Pay Bluepipes Blog